How much can a couple borrow mortgage

And having a job even a part-time one often helps with the transition from worker to retiree. You must meet standard bank policy without your partners income.

California Plan Book 2nd And Enlarged Edition Home Book Publishers Francis W Brown Ed Free Download Borrow And Streaming Internet Archive Plan Book How To Plan Case Study Houses

You can get a mortgage even if youre just starting your career.

. BushIt became law as part of Public Law 110-343 on October 3 2008 in the midst of the financial crisis of 20072008It created the 700 billion. Of course this depends on both parties circumstances and the addition of an applicant with very little or no income. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

And a couple of other mortgage details. September 18 2018 Loan-to-value ratio for mortgage. How much mortgage you can qualify for depends on how much debt a lender thinks you can take on.

Sometimes a lender will approve. Approximate price of property. Either way you will need to know what your principal is how much you will be borrowing the interest rate and the term length of your loan.

When mortgage lenders are trying to determine how much theyll let you borrow your debt-to. The pre-approval process can take a couple of days if you have complete documents and a good credit profile. The 2836 rule of thumb for mortgages is based on debt-to-income ratios to help figure out how much house you can afford but it may not account for all of your expenses.

You can calculate your mortgage qualification based on income purchase price or total monthly payment. We will ensure we give you a high quality content that will give you a good grade. Any person who is of 60 years or more can avail the reverse mortgage scheme.

Please note that the values provided can only be taken as an estimate of the amount to be borrowed. Our home loan borrowing power calculator could help you work out what you may be able to afford to borrow from a financial institution based on your income and expenses. 31000 23000 subsidized 7000 unsubsidized Independent.

With a personal loan you can borrow money from a bank or credit union to pay for the jet up front then repay the loan over time. Calculating mortgage repayments can either be done via a calculator like the one above manually via an equation or via a spreadsheet program. You can be approved for a mortgage with ratios higher than 2836 as.

LTV definition and examples March 17 2022. So if you have a 200000 mortgage and 40000 in savings you can offset these savings against your mortgage meaning youre only charged on 160000 of your mortgage. Please get in touch over the phone or visit us in branch.

In terms of mortgage affordability the VA loan is hard to beat if youre. If this is the maximum conforming limit in your area and your loan is worth 600000 your mortgage can be sold into the secondary. Your mortgage broker can get you a better interest rate when refinancing.

Todays national mortgage rate trends. However if you have credit issues on your record it can take. Mortgage loan basics Basic concepts and legal regulation.

How much could you potentially borrow for your mortgage. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. You dont always need years and years of work experience in order to get a home loan approved.

You can create a personal budget spreadsheet or use any number of budgeting apps or online budgeting tools. You can increase your home loan to pay out a divorce settlement. Pre-qualification is a casual estimate that determines how much money you can borrow for a mortgage.

Keep track of your income and expenses for a couple of months. VA mortgage rates can often be as much as 40 basis points 040 lower than rates for a comparable conventional loan. If this is also happening to you you can message us at course help online.

Whenever students face academic hardships they tend to run to online essay help companies. Find out how much you could borrow and what it could cost. The house to be mortgaged should have a residual life of at least 20 years or more.

That doesnt mean you have to borrow the entire amount if it would. In case of a married couple at least one of them should be 60 years of age or more. The general rule of thumb with mortgages is that you can borrow a mortgage that costs up to two and a half 25 times your annual gross income.

If youre applying for a mortgage jointly with someone else lenders will use your combined incomes to determine how much you can borrow which usually works out to much more than either applicant could afford on their own. We can handle your term paper dissertation a research proposal or an essay on any topic. This is a general estimate not an actual amount.

Total subsidized and unsubsidized loan limits over the course of your entire education include. Use our borrowing calculator to work out how much you could borrow for a home loan to buy a house and what your home loan repayments might be. Do bi-weekly mortgage programs pay your mortgage down faster.

Working while you are retired can make a difference in boosting your income and is a good way to fill your days. However there is a limit to what older workers can make and still receive full Social Security benefits. 2000 cashback when you refinance to us If youre eligible and you apply to move your home loan to us by 28 February 2023 you could get less home load with 2000 cashback.

A simple mortgage calculation that will take you less than 5 minutes to find out how much you could borrow discover our mortgage rates and the monthly mortgage payments. Ultimately your maximum mortgage eligibility is calculated by weighing your income against your debts purchase price of the house your down payment the mortgages interest rate as well as. Therefore a mortgage is an encumbrance limitation on the right to the property just as an easement would be but.

You can refinance and extend your mortgage to 95 of the property value. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. To be able to avail this scheme the applicant needs to own the house.

AOL latest headlines entertainment sports articles for business health and world news. Who can avail this facility. The Emergency Economic Stabilization Act of 2008 often called the bank bailout of 2008 was proposed by Treasury Secretary Henry Paulson passed by the 110th United States Congress and signed into law by President George W.

However getting a personal loan for a private jet is much more. You can still get your hands on your savings whenever you want. According to Anglo-American property law a mortgage occurs when an owner usually of a fee simple interest in realty pledges his or her interest right to the property as security or collateral for a loan.

Select Homes Of Moderate Cost National Plan Service Free Download Borrow And Streaming Internet Archive How To Plan Vintage House Plans House Plans

Pin On Mortgage And Loan

Mortgage Payment Made Too Early A Senior Couple In Pasco County Florida Faced Foreclosure Not For Missi Mortgage Rates Today Refinance Mortgage Mortgage Info

Pin On Funny True Or Just Damn True

Did You Know You Can Borrow For Major Expenses Like Education Expenses Home Renovation Or Weddings Through Ho Home Equity Home Improvement Loans The Borrowers

Mortgage Blog Mckinney Lender Service First Mortgage Reverse Mortgage Mortgage Mortgage Payment

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Pin On Cute Relationship Texts

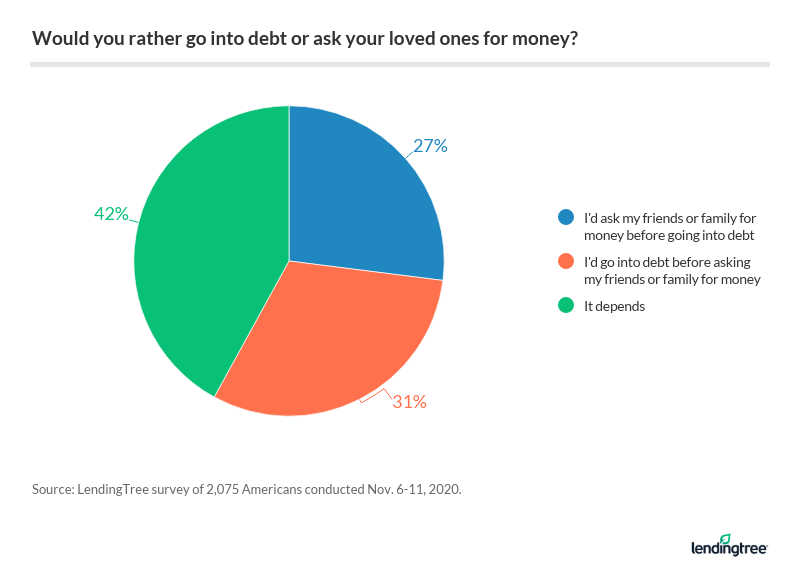

31 Of Americans Would Rather Go Into Debt Than Borrow From Loved Ones

Another Interesting Fact About This Provision Financial Strategies Life Insurance Policy Fun Facts

Premier Small Homes New Ideas By Small Home Architects Nationwide House Plan Service Free Download Borrow And Streaming Internet Archive In 2022 How To Plan Architect House House Plans

Pin By Keyona Mone T Renee On I Want Onee Cute Relationship Texts Relationship Goals Text Cute Relationship Goals

Mortgage Calculator How Much Can I Borrow Nerdwallet

Mortgage Calculator How Much Can I Borrow Nerdwallet

Mortgage Calculator How Much Can I Borrow Nerdwallet

:max_bytes(150000):strip_icc()/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

5 Things Not To Do During The Mortgage Process It Doesn T Mean You Definitely Won T Get Approved For The Loan But Informative Mortgage Process How To Apply